Understanding Your Profit & Loss Report (Without the Headache)

Let’s be honest, terms like “Profit and Loss Statement” (also called a P&L or income statement) sound like something only accountants need to worry about. But if you’re a small business owner, understanding your P&L can be one of the most useful tools for keeping your business on track.

It doesn’t have to be complicated. Here’s the thing: your P&L is actually telling you a story about your business. It shows whether you’re making money, where it’s coming from, and where it’s going.

Once you understand how to read it, you’ll have a much clearer picture of your financial health. Let’s break it down in a way that actually makes sense, so you can use your profit and loss statement to make smarter decisions without having to Google every other word.

What Is a Profit & Loss Statement?

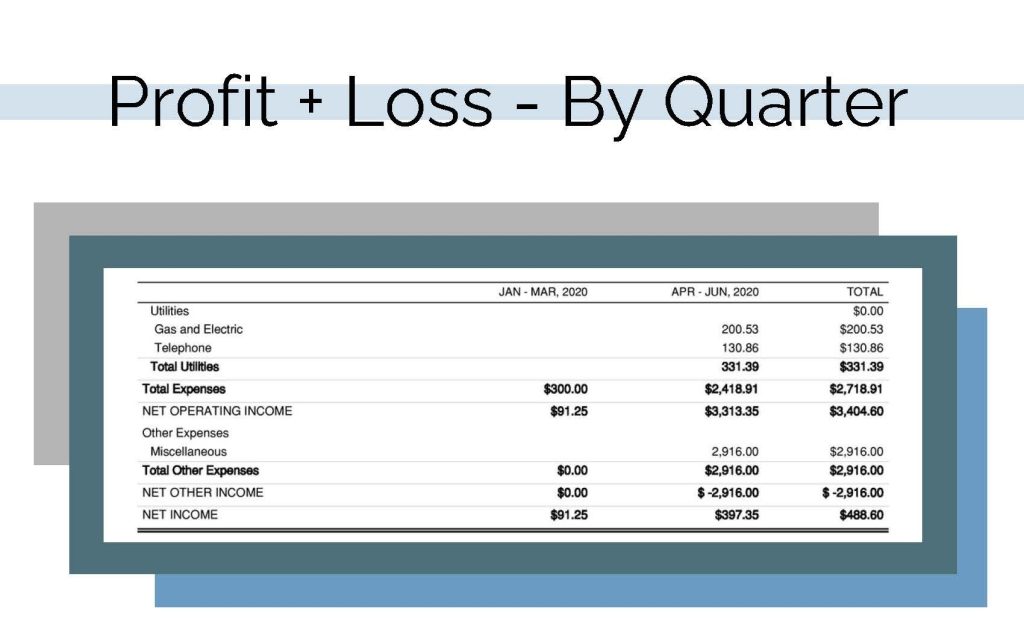

A Profit & Loss report shows your revenue, expenses, and profit (or loss) over a specific period, usually a month, quarter, or year. It’s a snapshot of your business’s financial performance during that time.

It helps answer one major question: Are you actually making money?

Your profit and loss report shows information from a particular point in time. It’s like seeing a paragraph on a page or a couple of chapters in a book. It’s not the full story, just a part of it that guides the reader to the end.

Why It Matters for Your Business

Even if you have someone else handling your books, understanding your P&L gives you insight into:

-

-

How much you’re spending

-

Where your income is coming from

-

Whether your business is profitable

-

How your financial trends are changing over time

-

It’s not just about taxes. It’s about staying informed and confident as a business owner.

The Basic Structure

Here’s what you’ll typically see on a Profit & Loss Statement:

Revenue (Income)

The total income from sales, services, or other business activities

If you invoice clients, this will reflect what’s been recorded—not necessarily what’s been paid.

Cost of Goods Sold (COGS)

The direct costs of producing your products or services (like materials or subcontractors)

Only applies if you sell goods or track direct service delivery costs.

Gross Profit

Revenue minus COGS

This tells you how much is left after covering production or service costs.

Operating Expenses

Your regular business expenses like rent, wages, software, advertising, office supplies, and insurance

Usually easiest to read if organized by category so you can spot trends.

Net Profit (or Net Income)

What’s left after subtracting expenses from income

This is your “bottom line.” Positive = profit. Negative = loss.

Wait… So Why Doesn’t It Match My Bank Account?

Here’s the part most people misunderstand: your P&L does not reflect everything that affects your bank balance.

It does not include things like:

-

-

Loan principal payments

-

Owner’s draws or personal transfers

-

Equipment purchases (unless expensed)

-

Credit card payments

-

So if you’re looking at your net profit and wondering, “Where did all that money go?” . . . . you’re not crazy. Those payments don’t show up on the Profit and Loss Statement. They are typically found on the Balance Sheet or Statement of Cash Flows instead.

How to Use Your P&L to Make Better Decisions

You don’t have to memorize every line, but reviewing your P&L monthly helps you:

-

-

Spot rising expenses before they get out of control

-

See which revenue streams are performing best

-

Make realistic plans for taxes, savings, and growth

-

Know when it’s time to raise prices or cut costs

-

Think of your P&L as a snapshot. The more often you look at it, the more confident you’ll feel making decisions.

Common Mistakes to Avoid

-

-

Only checking it at tax time

-

Ignoring categories and lumping expenses together

-

Not reconciling accounts first (which can throw off your numbers)

-

Confusing revenue with profit

-

Final Thoughts

Your Profit and Loss Statement doesn’t need to be intimidating. It’s one of the simplest and most powerful tools in your financial toolkit, especially once you understand how to read it.

Want More Help?

Grab our free P&L breakdown PDF here.

A no-fluff, practical guide to help you get a handle on your numbers.

❓ Questions? Reach out anytime – our bookkeeping services include reporting help.

Like this post? Get more like it in your inbox.